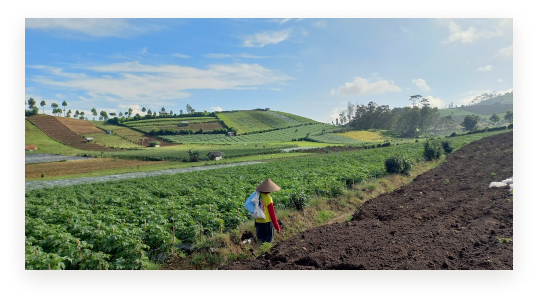

Agriculture

Search Bar

Breadcrumb

Access Incentives

Close a Business

Acquire Land

Obtain Accreditations

Secure Approvals

-

Secure Approvals

-

Tourism Product Development Company (TPDCo.)

- Accommodations

- Attractions and Others

-

Licenses and Leases

- Cannabis

- Farms

- NCRA - Food Processing Establishment

- WRA - Water Resources Authority Services

- Energy Plant

- Telecoms Operation

- Institutional Healthcare Facilities - Healthcare Facilities

- Quarry Licence

- Mining Lease

- Registration of Film Production

- Pharmaceutical License

- NCRA(Verification of Scales And Petrol)

- MIIC(CET and Safeguard Mechanism)

-

Building and Construction

- Electricity Connections

- Water and Sewerage Connections

- Fire Brigade

-

Development and Promotion

- SEZ. Status

Registers

Business Support Services

Digital Secure Approvals

-

Secure Approvals

-

Tourism Product Development Company (TPDCo.)

- Accommodations

- Attractions and Others

-

Licenses and Leases

- Cannabis

- Farms

- Pharmaceutical License

- Registration of Film Production

- Fire Brigade

- NCRA(Verification of Scales And Petrol)

- MIIC(CET and Safeguard Mechanism)

- Institutional Healthcare Facilities - Healthcare Facilities

- Quarry Licence

- Mining Lease

- NCRA - Food Processing Establishment

- WRA - Water Resources Authority Services

-

Development and Promotion

- SEZ. Status

Digital Access Incentives

Digital Obtain Certifications

Digital Obtain Accreditations

Digital Acquire Land

Business Support Services

Digital Business Support Services

Menu Display

Agriculture PIR Incentive

Secure a Permit in order to access and derive Productive

Input Relief (PIR) Duty Free Concessions

Common Banner Button For Agriculture

Process Overview

Discover the application process and what steps must be taken in order to access Agricultural (Productive Input Relief) Incentives.

Agriculture License Description

Under the Omnibus Incentives Regime, the Customs Tariff (Revision) Resolution is geared towards the productive sector, and provides for the duty-free importation of capital equipment, raw materials and other industry-related consumer goods. The key benefit is the introduction of the Productive Inputs Relief (PIR) scheme. Special categories have been created for companies in the manufacturing, agriculture, tourism and health sectors, along with companies within the creative industries

While there is no application necessary for you to access the benefits under the Omnibus Incentives framework, an individual or entity seeking to benefit from the Productive Inputs Relief (PIR) system must first register with the respective regulating Ministry for status as a bona fide ‘Producer’. The Ministry of Agriculture and Fisheries (MOAF) is the regulating Ministry for the Agriculture sector. For more information about accessing this incentive continue to the next step of this business process guideline.

Items that are imported and landed in Jamaica prior to the final “Status” designation being awarded to your company, will not be covered by the agriculture fiscal incentives, as the benefits cannot be applied retroactively. Where goods are imported prior to the grant of the farmer/producer status, you will be required to pay all the applicable border taxes.

The relief is normally for a period of ten (10) years in the first instance but may be extended another five (5) years by the Minister with responsibility. Criteria taken into account in granting any further relief include: i) thepotential foreign exchange earnings/ savings, and ii) the viability and profitability of the enterprise.

As a Farmer (individual or entity), in order to benefit from the Productive Inputs Relief (PIR) scheme, you must first register with the regulating Ministry, MOAF, for status as a bona fide ‘Farmer/Producer’. Only a business, that has been approved by MOAF and recommended to the Jamaica Customs Agency (JCA) may benefit under the PIR scheme.

The designation of a company as a “Producer” is based on the provisions of the Customs Tariff (Revision) (Amendment)Resolution 2013, which outlines the material considerations that are involved in the process of determining whether or not your company will be granted the “producer” designation in a specific sector/industry.